U.S. Green Building Council Announces Top 10 U.S. States for Green Building in 2023

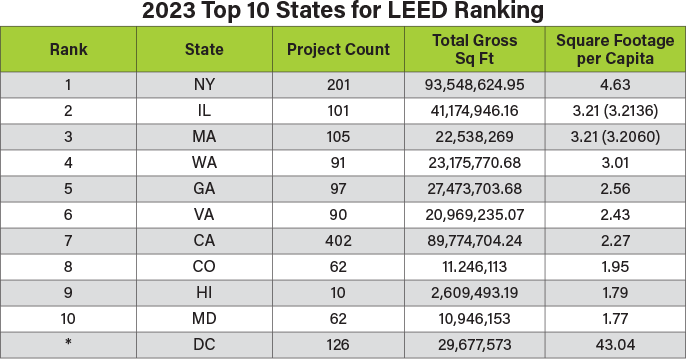

The U.S. Green Building Council has released its annual list of Top 10 States for LEED. For the first time ever, New York ranked number one, based on LEED-certified gross square footage per capita over the past year, leading the country in green building.

New York totaled 201 newly LEED-certified projects in 2023 that encompassed more than 93 million square feet, equating to nearly 4.6 LEED-certified square feet per resident. Following behind was Illinois (3.213 square feet per capita), Massachusetts (3.210 square feet per capita), Washington (3.01 square feet per capita) and Georgia (2.56 square feet per capita). Though not officially on the list because of its status as a federal district, the District of Columbia continued to lead nationally with more than 43 certified square feet per capita.

USGBC offers LEED and other industry-shaping resources to aide reducing greenhouse gas emissions in new and existing buildings. A new record was set in 2023 for adding the most LEED-certified gross square footage (GSF) of green building space in a single year as the world saw alarming climate impacts including record-setting temperatures and storms of increasing intensity. In total, there were more than 6,000 LEED-certified commercial projects worldwide, representing 1.36 billion GSF.

In 2023, USGBC introduced a draft of its LEED v5 for Operations and Maintenance (O+M) rating system for existing buildings. LEED v5 is the newest version of LEED and marks a transformative milestone in the built environment’s alignment with a low-carbon future and addresses critical imperatives such as equity, health, ecosystems and resilience.

To underscore these imperatives, USGBC has released an embodied carbon report with RMI (founded as Rocky Mountain Institute) and published a State of Decarbonization report alongside global sustainable development firm, Arup. The State of Decarbonization report outlines key market drivers for LEED and other climate solutions.

Top 10 Equipment Acquisition Trends for 2024

The Equipment Leasing and Finance Association, which represents the $1 trillion equipment finance sector, has revealed its Top 10 Equipment Acquisition Trends for 2024. Real private investment by U.S. businesses in equipment and software is forecast to be more than $2 trillion in 2024, with a substantial amount of that investment activity financed, so these trends impact a significant portion of the U.S. economy.

ELFA distilled recent research and data, including the Equipment Leasing & Finance Foundation’s “2024 Equipment Leasing & Finance U.S. Economic Outlook,” industry participants’ expertise and member input from ELFA meetings in compiling the trends.

ELFA forecasts the following Top 10 Equipment Acquisition Trends for 2024:

The U.S. economy will likely have a soft landing. While a recession is still possible in the first half of 2024, the likelihood of a “soft landing” is increasing. The combination of cooling inflation, a healthy labor market and improved consumer sentiment support a forecast of 1.7% growth in real U.S. GDP.

The pace of growth in capital spending will improve during the year. Real equipment and software investment growth of 2.2% is expected this year. While slightly slower than the growth rate experienced in 2023, stronger investment activity is expected in the latter half of the year.

Downward pressure on interest rates will ease borrowing costs. After a tumultuous higher interest rate environment, easing inflation has led the Federal Reserve to plan for incremental rate cuts in 2024 and beyond. These will be welcome developments amid tightened credit availability and weaker credit demand.

The majority of equipment acquisitions will be financed. In 2024, more than half (54%) of equipment acquisitions are forecast to be financed. Eight out of 10 businesses will use leases, secured loans or lines of credit for their acquisitions as they find these to be beneficial options compared to outright purchases of equipment.

Automation and robotics will drive major investments by industrial businesses. Businesses in logistics, retail and consumer goods, food and beverage, and the automotive industries will lead in investment in robotics and automation. A general lack of experience with the new technology will require equipment manufacturers (OEMs) and dealers to focus on providing quality customer service to help get end users up and running. Globally, industrial automation is forecast to grow over 8% annually through the decade.

Equipment-as-a-service will ease businesses’ access to productive assets. With the global equipment-as-a-service (EaaS) market growing at an annual compound rate of around 50% through 2030, more U.S. businesses will deploy subscription-based equipment usage. They will shift from a capital expenditure to an operating expense model to eliminate substantial upfront investment and have greater flexibility as equipment OEMs provide a single point of contact for equipment and related software, supplies and services.

Businesses will dive deeper into AI. As automation and robotics handle specific, repetitive tasks, U.S. businesses will explore ways to incorporate artificial intelligence that recognizes data and simulates human thinking into their processes. Marketing and technology functions lead in AI use, and other early adopters will enjoy competitive advantages.

Many equipment types will thrive as still-elevated interest rates drag on investment growth. While equipment and software investment is unlikely to experience breakout growth in 2024, construction machinery, computers, software and aircraft are strongly positioned through the first half of the year. Materials handling equipment investment also looks promising despite falling growth in 2023.

Investment in climate-focused projects will accelerate. Climate-focused initiatives will continue to grow in industries from transportation to consumer goods as regulators, consumers and partnering businesses in the value chain require compliance. Projects will be supported by unprecedented funding from sources including the Inflation Reduction Act, and financing from financial institutions and independent lenders.

“Wild cards” will factor into business investment decisions. Businesses will keep an eye on other areas that could impact their equipment acquisition strategies in addition to the trends above. A global economic slowdown, the Israeli-Hamas war, Russia-Ukraine war, continued animosity between the United States and China, and the 2024 elections are among the impacts to watch this year.

Construction Industry Adds 11,000 Jobs in January

The construction industry added 11,000 jobs in January despite bouts of exceptionally cold or stormy weather that delayed projects in numerous regions, according to an analysis of government data the Associated General Contractors of America. Association officials noted that firms are boosting wages and taking other steps to attract more workers as firms try to keep pace with relatively strong demand.

“Although job gains were modest last month, other evidence suggests there is still lots of demand for workers,” said Ken Simonson, the association’s chief economist. “Wages rose faster than in other sectors, job openings at the end of 2023 were at near-record levels for December, and construction spending jumped that month.”

Construction employment in January totaled 8,137,000, seasonally adjusted, an increase of 11,000 or 0.1% from the upwardly revised December total. The sector has added 216,000 jobs during the past 12 months, a gain of 2.7%. Residential building and specialty trade contractors added 2,700 employees in January and 60,100 (1.8%) over 12 months. Employment at nonresidential construction firms—nonresidential building and specialty trade contractors along with heavy and civil engineering construction firms—climbed by 7,600 positions for the month and 155,100 (3.3%) since January 2023.

Average hourly earnings for production and nonsupervisory employees in construction—covering most onsite craft workers as well as many office workers—climbed by 5.3% over the year to $35.21 per hour. Construction firms in December provided a wage “premium” of nearly 19% compared to the average hourly earnings for all private-sector production employees.

Earlier government reports on job openings and construction spending show demand for construction workers and projects remains robust, the economist said. Job openings in construction at the end of December totaled 374,000, not seasonally adjusted, greatly exceeding the 227,000 workers hired and implying that contractors want to hire far more workers than they are able to find, Simonson said. In addition, spending on projects under way that month totaled $2.1 trillion at a seasonally adjusted annual rate, 0.9% higher than in November and 14% higher than a year earlier.

Construction Backlog Indicator Slips in January, Contractors Remain Confident

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.4 months in January, according to an ABC member survey conducted from Jan. 22 to Feb. 4. The reading is down 0.6 months from January 2023.

Backlog increased to 10.9 months in the heavy industrial category, the highest reading on record for that category, and is 2.5 months higher than in January 2023. Backlog is down on a year-over-year basis in the commercial/institutional and infrastructure categories.

ABC’s Construction Confidence Index readings for sales and staffing levels increased in January, while the reading for profit margins declined. All three readings remain above the threshold of 50, indicating expectations for growth over the next six months.

“As predicted, performance in the nonresidential construction sector is becoming more disparate across segments,” said ABC Chief Economist Anirban Basu. “For much of the pandemic recovery period, contractors in virtually all segments were indicating stable to rising backlog. That remains the case for contractors most exposed to the nation’s industrial production. Reshoring and near-shoring continue to drive construction spending.

“In other categories, however, including those most interest rate-sensitive, activity appears to be slowing,” said Basu. “Developer financing has become both more expensive and more difficult to obtain over roughly the past year, in part because of rising office vacancy in many markets. That helps to explain declining backlog in the commercial category. The decline in infrastructure-related backlog may be due only to seasonality, however. There is every reason to believe that contractors specializing in public works will have a very busy year.”

Construction Spending Rises 0.9% in December

Total construction spending increased by 0.9% in December and 13.9% year-over-year, as gains in residential and public segments offset mixed results among private nonresidential markets, according to an analysis of federal spending data the Associated General Contractors of America. Association officials cautioned that higher interest rates, labor shortages and regulatory delays could impact future construction spending levels despite overall strength in the market.

“Construction spending rose across the board in 2023 despite higher interest costs, shortages of workers, and delays in awarding federal money for infrastructure,” said Ken Simonson, the association’s chief economist. “These challenges remain in early 2024 but the industry is poised for further growth overall.”

Construction spending, not adjusted for inflation, totaled $2.096 trillion at a seasonally adjusted annual rate in December. That figure is 0.9% above the upwardly revised November rate and 13.9% above the December 2022 level.

Spending on private residential construction rose by 1.4% and 6.8% year-over-year. Single-family construction climbed for the eighth-straight month, by 1.6%. Spending on multifamily projects rose 0.3%.

Public construction spending increased 1.3% in December and 21.3% from a year earlier. Spending on the largest public category, highways and streets, jumped 4.1% for the month, while outlays for educational structures slipped 0.1%. Spending on transportation facilities rose 1.1%. Other infrastructure segments were mixed: sewage and waste disposal declined 0.8% and water supply spending slumped 2.5% but conservation and development outlays rose 1.4%.

Spending on private nonresidential construction dipped 0.2% in December but increased by 19.1% from December 2022. The largest segments mostly declined for the month. Manufacturing construction edged down 0.1%. Commercial construction—comprising warehouse, retail and farm projects—declined 0.5%. Investment in power, oil and gas projects rose 0.3%. Spending on offices and data centers decreased by 0.2%, and health care construction fell 0.8%.

Saint-Gobain Acquires International Cellulose Corporation

Saint-Gobain has acquired the business assets of International Cellulose Corporation, a privately owned manufacturer of commercial specialty insulation products, including spray-on thermal and acoustical finishing systems.

ICC’s product portfolio complements existing Saint-Gobain insulation solutions such as GCP’s fireproofing products, acquired by Saint-Gobain in 2022, and CertainTeed’s interior insulation portfolio.

International Cellulose Corporation will join CertainTeed’s Commercial Building and Infrastructure business, in the Americas Region. The acquisition includes the assets of Ecosorb International, a subsidiary of International Cellulose Corporation.